|

|

Language: |

|

|

||||

| |

Effects of massive pipelines on oil prices

Decidedly, 2017 will be the year of pipelines. Let's draw a parallel with the internet if we should. This article comes to your computer reliably through a series of pipes that did not exist 20 years ago. In many aspects, today's oil delivery infrastructure is still like the internet of two decades ago trickling over an unreliable modem connection. But all of that is about to change. Much like today's internet, a reliable network of pipelines is about to see the light of day from oil fields to refineries. Much like the internet, some of the pipe routes are redundant by design to ensure that no single conflict or cartel (we're looking at you, OPEC) can possibly shut them down. In fact all major pipeline projects we will cover today purposely bypass Middle-Eeastern producers altogether. Like the internet's "least cost routing", this mesh of pipelines should pave the way for a more cost-efficient energy delivery infrastructure. These are interesting times we live in. We are about to enter a new era of energy stability, starting in 2017, which we coin "the year of pipelines". PipelinesDepending on the available infrastructure, today's oil is carried to refineries in a variety of ways. These include rail, ships trucks and pipelines. Of all these options, pipelines - when available - are preferred, because pipelines are fuel effective, cost efficient, environmentally friendly (friendlier anyway) and comparatively safer. In the U.S., of the 1.38 million miles of long distance transmission pipelines, 150,000 miles carry oil, while 1.23 million miles move natural gas. Already there's a spike in the number of pipelines under construction or on the verge of completion. In many ways, pipeline projects are all set for a swirling upsurge under President Trump. President Donald Trump has signed an executive order not only to revive the Dakota Access and Keystone XL oil pipelines but also expedite the projects. Unblocking the final phase of the 1,172 mile pipeline would mean easy transportation of oil from the Bakken oil field in North Dakota to refineries near Chicago. And, Keystone XL will hasten oil from Alberta, Canada to join another pipeline in Nebraska in bringing oil to Illinois. Apart from the much talked about Keystone XL and Dakota Access Pipeline (DAPL), there are scores of other pipelines very much in the picture. The Sacagawea pipeline, with 100,000 bpd capacity, will be running beneath Lake Sacagawea and transporting oil from McKenzie and Dunn Counties to Mountrail County. Once completed, Lebanon Hills pipeline, an eight mile pipeline, will move natural gas to Xcel Energy's Black Dog Power Plant in Burnsville, Minnesota. The under-construction, Sabal Trail Pipeline will supply more than 1 billion cubic feet of natural gas from Alabama to Florida. Meanwhile, the 148 mile long Trans-Pecos Pipeline, will transport 1.4 billion cubic feet of fracked natural gas from Permian Basin to Mexico. Striking where it matters, Trump administration is planning to expedite permits for drilling, meaning more and more pipes on the ground. In addition, fast environmental reviews for high priority infrastructure projects mean more activity on the ground. Meantime, as mentioned in our previous article, Russia is also busy building pipelines: Turkish Stream gas pipeline would deliver gas from Russia to Turkey, while the Nord Stream - 2 gas pipeline would bring gas to Germany via the Baltic Sea. So, let's:

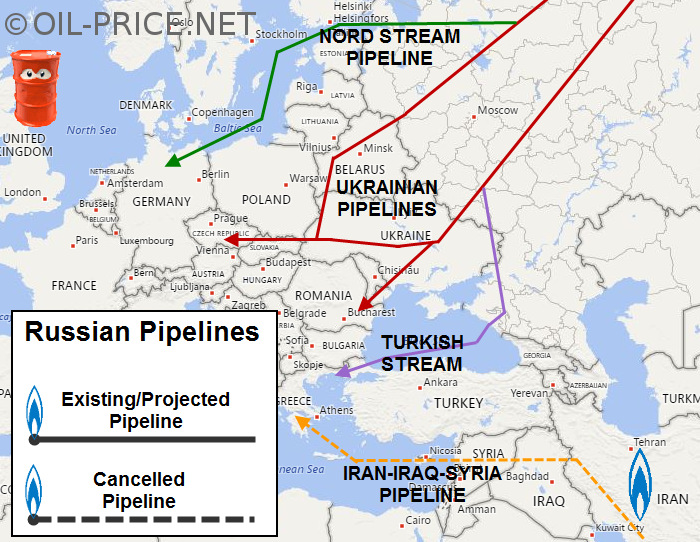

Who stands to win?Smart money and Warren BuffettThere are two ways to observe trends: observe what most people do, or what smart people do. Since you are presently reading our articles, you obviously believe that smart people beat the crowds. Of course Buffett, the poster child of smart money (or should we say "poster grandfather"?) stands to win as usual. Smart money was quick to figure out that with a real estate magnate as the US President and Exxon's ex-CEO as US Secretary of State, we are in for some significant infrastructure build outs. Warren Buffett bought top oil and gas pipe maker Wilhelm Schulz the day before Trump signed executive order to build keystone XL pipeline. Trump has promised that the pipeline will be built with "American steel". Coincidentally, following Buffett acquisition, German pipeline maker Schultz became as American as Schwarzenegger. Schulz already has pipeline extrusion facilities in Tunica Mississippi and stands pretty for the Keystone and Dakota pipelines. Fracked oil has been brought to refineries on Buffett's trains up until now. Since Warren's rail road system enjoys a sort of monopoly in oil transportation, perhaps a pipeline would be bad for business. Or, would it really? A while ago we wrote an article explaining how Buffett bought a railroad to control the transit of oil from oil fields. Burlington Northern Santa Fe (BNSF), was bought for $34 bn, in yet another masterstroke by the brilliant visionary. BNSF railroad crude oil shipments have declined significantly since the industry wound down due to lower prices. As oil prices are steadying above $50 and wells resume operations, a pipeline business offers insurer Berkshire Hathaway a hedge: the pipeline business "hedges" against reduction in crude oil freight and the rails business hedges against pipeline deferrals. After all, hedging one's bets is how the business of insurance works. Building tycoons of the energy industry think in terms of pipes. Like: Schulz, the cutting- edge manufacturing plant serves varied industries not limited to oil and gas pipelines (pumping stations & refineries, including deep-sea drilling platforms), Nuclear power plants, Aircraft parts and application and Industrial manufacturing. Warren Buffett's Berkshire Hathaway acquired nearly $400 million stake in pipeline operator Kinder Morgan and sold out the holdings recently. On the other hand, Berkshire has steadily increased stakes in Phillips 66, a company with large presence in the pipeline business. Berkshire's Schultz subsidiary and Phillips 66, will also stand to benefit from the pickup in drilling as it provides pipes for drilling as well. ExxonMobil whose ex-CEO Rex Tillerson now serves as US Secretary of State, recently announced a $6 billion acquisition of Permian Basin resources in Texas, expecting drilling to pick up at any time. What's intriguing is that it, on the ground, many of the companies in the Permian basin as well as Cana Woodford and Eagle Ford regions are massively hiring anticipating a positive tide on the energy side at any moment. Whereas low oil prices had caused drilling to stop, sustained $50+ oil prices are here to stay and exploration is picking up. US rig count stands at 741 today, an increase of 200 rigs or 37% over a year ago, with Texas adding the largest to the total with 362 rigs. The rig count has increased in Canada too from 222 a year ago to 352 in February. Clearly, these rigs need pipes, which is good for pipe makers like Schultz. In Europe, Berkshire Hathaway ownership of German pipe extruder Schultz is likely to earn biusiness from Russia's giant pipeline projects into Germany outlined in our previous article concerning Russia's attempt to corner the European market. RussiaRussia, which surpassed Saudi Arabia as the world number one oil and gas producer (on a daily basis), is building two major natural gas pipelines into Europe: Nord Stream into Germany and Turkish stream, a redundant pipeline directly into Southern Europe. Despite protests from the EU against Russia's apparent intent to garner a monopoly on Europe's energy supplies, when it comes to energy sources, Russia remains the sexiest horse in the glue factory, being able to bring cheap energy reliably into Europe without financing the spread of Islamist enclaves like Gulf States.  Figure 1 - Map of Russian gas pipelines into Europe

Furthermore, Europe isn't alone: Russia's shadow engulfs Venezuela too. Russia has granted huge loans to Venezuela for social investment and infrastructure. The state owned company Rosneft stands to win in Venezuela as well. Unlike the US which sanctioned both Venezuela and Russia, Russia has increased investment into the near-bankrupt nation and Russian oil companies have gradually gained favor and displaced western competitors in Venezuela's major oil fields as Venezuela considers Russia a better strategic partner, able to help modernize Venezuela's aging oil infrastructure, the lifeblood of its economy. It comes as no surprise that Russian Rosneft increased its share to 40 percent in PetroMonagas, a joint venture with Venezuela's Petroleos de Venezuela (PDVSA). Interesting enough, the billions invested by Russia has paid off and by our own estimates, Russian companies now also controls 40% of Venezuela's Orinoco belt, the largest proven reserves in the world with 300 billion barrels, supplying 9% of US crude imports.

RefinersCanada has one of the world's largest oil reserves next only to Saudi Arabia and Venezuela. Pipeline companies have heavily invested in Alberta oil sands as it's easier and cheaper to transport and distribute oil sand products from Canada. While Keystone XL will move crude from Alberta to the US directly, the Dakota Access Pipeline will also transport Canadian oil because DAPL has enormous capacity and no one is going to leave the space unutilized. Either way, refiners get Canadian oil ducted directly to their refineries. No surprise then that shares of TransCanada, the company operating and developing Keystone XL, rose 4 percent soon after Trump's order. In its own way, all things considered, it's a win-win situation for the US and Canada as well. Canadian producers can now offload crude oil on the US market efficiently. It lowers transportation costs which, as we explained in this article, refiners won't pass entirely down to consumers. This means more profits for refiners. Other winnersAs far as US oil producers are concerned, it's a mixed bag. Some lose because of keystone but easier permits and South Dakota pipeline access will benefit others. Share prices of companies involved in pipeline projects have rallied with the executive order of President Trump. That includes US steel companies since Trump's order stipulates contractors to use only U.S. materials. Who stands to lose?OPEC countriesSaudi Arabia and Qatar's bid on a Syrian pipeline not only failed by destabilizing Syria, making it unfit to host a pipeline in the foreseeable future, it also backfired immensely: As we predicted in http://www.oil-price.net/en/articles/oil-prices-and-syrian-civil-war.php, Russia adopted the "funneling tactic" in fighting ISIS to counter Saudi Arabia: rather than directly obliterating ISIS and other ragtag groups (which Russia could), Russia is using restraint and forcing Islamic fighters south towards Saudi Arabia. It works: ISIS troops have been building up in the South of Iraq and in January the group successfully led a raid into the Kingdom, killing one Saudi general. Now instead of building a pipeline, the Kingdom is building a 600 mile wall to prevent ISIS fighters, funneled by Russia to invade Saudi Arabia on a large scale. With five layers of fencing, deep ditches, watch towers, night vision cameras and radars, the wall will separate Saudi Arabia from Iraq. Additionally, 30,000 troops patrol the area to cut off the ISIS menace. The wall highlights the priorities OPEC nations are dealing with right now. As pipelines are laid across the rest of the world entirely bypassing Gulf states, OPEC nations will find themselves more isolated and see their geopolitical influence dwindle. RailroadsCanadian Pacific Railway and Canadian National Railway entered the crude oil transport only in 2010 as infrastructure crunch in the form of inadequate pipelines emerged in North Dakota's Bakken and Canada's Alberta. By 2014, the revenue of Canadian Pacific Railway jumped to about half a billion, while Canadian National Railway clocked over two billion dollars. At its peak, crude exports by rail amounted to 179,000 barrels a day in September 2014 from under 10,000 barrels a day early in 2012. Going forward, Dakota and Canadian oil volume will shift towards pipes resulting in lower volume on rails. For good reasons, though. It's almost five times more expensive to transport oil by rail than pipe. Compounded by low oil prices, crude exports by rail fell by nearly half from 161,000 barrels a day in 2014 to 89,000 barrels a day as of last November. The drop is expected to intensify as pipelines score in every marker. It's a wash if, like Buffett, you hedged your bets and own both. TankersLast November, OPEC cut production followed by Russia and other non-OPEC producers. Since then, with the twin blow of low demand and more tankers, the freight rates dropped by as much as 30 percent since the beginning of 2017. Tankers, in fact, will lose more as volume shifts away from them. EuropeEuropean consumers lose out as European leaders don't stand up to Russia: Take the case of Nord Stream 2 project. Said to have a total capacity of 55 billion cubic metres of gas a year, the project has two pipeline strings. When the expansion was announced in 2014, many countries including U.S. raised objection. For one, the project increases Europe dependence on Russia. So, Russia has an added tool in the bag to squeeze Europe at any time. Now, countries like Sweden, Denmark and Germany have relented, and the European Commission is silent on its decision. As for US, Trump is pro-Russia and pro-fossil fuel. So, indications are that Nord Stream 2 opposition has lost steam. EnvironmentRiding roughshod over the environment has both consequence and payback. Should there be a spill or explosion, the resultant pollution on land and water will be massive. After all, oil from shale and Oil sands are more corrosive with increased chances of pipeline failure. Remember, not long ago, we had spills into the Kalamazoo River in 2010 and in Tioga, North Dakota in 2013. Still, although not ideal, pipelines are an order of magnitude safer than transporting crude oil by rail. What it means for oil pricesKeystone will bring plenty of Canadian oil to US refiners. And if DAPL ends up carrying Canadian oil too, the refiners will thank their stars. Surely, together with other pipelines, this gives pricing power to US refiners over US producers. U.S. still imports more than a million barrels of crude a day. As per latest reports, US producers exported 7 million barrels of crude oil in a week. With a robust infrastructure in place with added pipelines and export terminals, the export may see more growth. So oversupply of crude can depress the oil prices. Also, stockpiles of oil increased to 518 million barrels so expect lower WTI oil price in the near term. In general, as we mentioned earlier, pipelines mean safer, cheaper and more reliable oil delivery infrastructure, which also makes gas cheaper. Trans-national pipelines like Nord stream and Turkish stream also provide a financial incentive for countries they traverse to ensure their safety: transit royalties can be significant and a boon to the local economy. A well fed population is less likely to revolt. Whereas pipelines bring stability; they also demand stability or will be bypassed by redundant routes as is about to happen in Ukraine. To sum up, oil prices stand neither to go up or down but remain steady, and that's a good thing. More reliable petroleum delivery routes that bypass the Middle East reduce the ability of OPEC to artificially inflate oil prices. Oil will trade more like a regular commodity, and its price will see less fluctuations. In fact we have started to witness this over the last 3 months: Despite OPEC's successive announcements of production cuts, oil prices have mostly ignored OPEC and remained steady in the $50 range. Three years ago, the same announcement would have meant $100 oil. Previously, huge jumps in oil prices were caused by inelasticity of supply. This will remain history as these massive builds in infrastructure take place. This is not to say that all looks bright, going forward. As the newly formed US government focuses inwards creating a "vacuum of international leadership", Russia is quick to fill to pick up the slack and forge key strategic alliances including control over 40% of Venezuela's Orinoco basin, the world's largest proven reserves, in addition to cornering Europe's energy supplies. Despite sanctions, the Russian economy has seen an upswing on the heels of recovering oil prices. The Ruble - Russia's currency - which has been floating for last two years has now stabilized. Which prompts the following question: What prevents Russia, the world's largest crude oil exporter from turning the Ruble into a petrocurrency (like the petro-dollar) by demanding settlements of oil payments in Rubles? This is a truly grave question. Let us not forget the one good thing about OPEC: it is in no small part thanks to OPEC countries settling oil payments in US dollars that the "petro-dollar" has become the world's foremost currency enabling the US to attract foreign investments to finance debt. Without debt financing, many things - including the Trump tower - would be smaller. Conversely a weakened OPEC reduces the permanent demand for US dollars worldwide. This comes at a time when the Trump administration demonstrates unwillingness to sustain US international influence and gradually withdraws from a leadership role at the global level. Furthermore, the administration's hostile stance towards its own intelligence agencies - unanimous critics of Russia - will unavoidably embolden Putin to challenge the US influence on energy markets. | ||

|

© oil-price.net 2009, all rights reserved. Permission to redistribute articles from oil-price.net on other sites can be obtained by contacting us. Redistributed articles must contain a copyright notice and a link back to http://oil-price.net as follows:

| ||

|

|